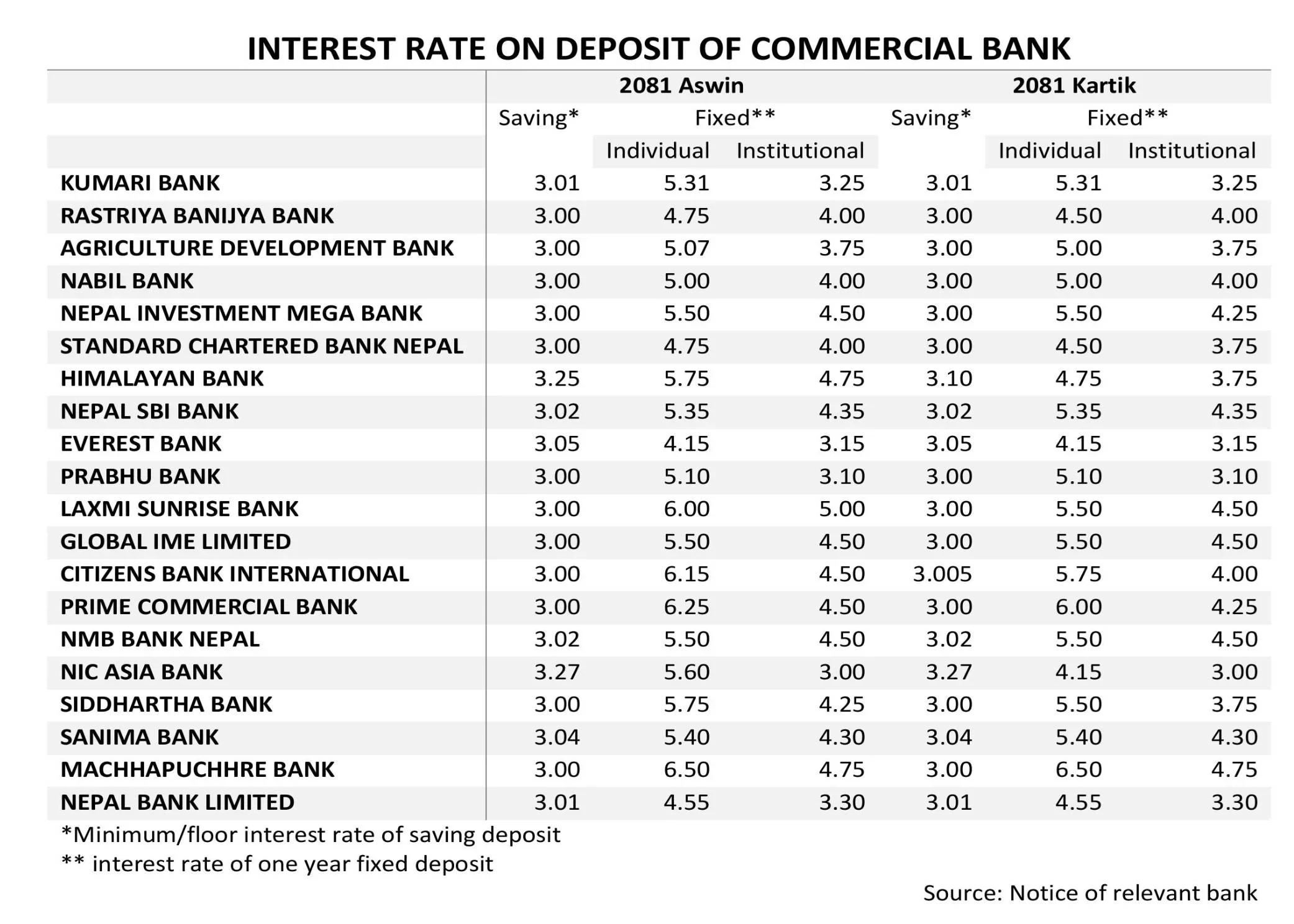

Interest rates for Kartik announced: 10 banks cut rates, 10 hold steady

Kathmandu, October 16 — During the festive season, the expected demand for loans from banks and financial institutions has not materialized, leading to a continued stability in interest rates. Commercial banks have published their interest rates for the month of Kartik accordingly.

As per the regulations, banks are required to announce interest rates for the new month by the end of the previous month. In this context, 10 banks have reduced their interest rates, while the remaining 10 banks have maintained the same rates as the previous month. No bank has increased interest rates this time.

New interest rates from banks:

Kumari Bank

Maintained interest rates for all deposit types—3.01% for savings, 5.31% for personal term deposits, and 3.25% for institutional deposits.

Rastriya Banijya Bank

Reduced personal term deposit rates by 0.25%. Current rates are 3.00% for savings, 4.50% for personal term, and 4.00% for institutional deposits.

Agriculture Development Bank

Kept savings and institutional deposit rates stable, while personal term deposit rates were reduced by 0.065%. New rates are 3.00% for savings, 5.00% for personal, and 3.75% for institutional deposits.

Nabil Bank

Maintained rates for savings and one-year deposits—3.00% for savings, 5.00% for personal, and 4.00% for institutional deposits.

Nepal Investment Mega Bank

Kept savings and one-year personal deposit rates stable, but reduced institutional rates by 0.25%. New rates are 3.00% for savings, 5.50% for personal, and 4.25% for institutional deposits.

Standard Chartered Bank

Kept savings rates stable while reducing personal and institutional rates by 0.25%. New rates are 3.00% for savings, 4.50% for personal, and 3.75% for institutional deposits.

Himalayan Bank

Reduced all interest rates—savings by 0.15%, and both personal and institutional by 1.00%. New rates are 3.10% for savings, 4.75% for personal, and 3.75% for institutional deposits.

Nepal SBI Bank

No changes in interest rates. Rates remain at 3.02% for savings, 5.35% for personal, and 4.35% for institutional deposits.

Everest Bank

Maintained rates—3.05% for savings, 4.15% for personal, and 3.15% for institutional deposits.

Prabhu Bank

No changes in rates—3.00% for savings, 5.10% for personal, and 3.10% for institutional deposits.

Laxmi Sunrise Bank

Maintained savings rates but reduced personal and institutional rates by 0.50%. New rates are 3.00% for savings, 5.50% for personal, and 4.50% for institutional deposits.

Global IME Bank

Kept rates stable—3.00% for savings, 5.50% for personal, and 4.50% for institutional deposits.

Citizens Bank

Increased savings rates by 0.005% but decreased personal by 0.40% and institutional by 0.50%. New rates are 3.0005% for savings, 5.75% for personal, and 4.00% for institutional deposits.

Prime Commercial Bank

Maintained savings rates while reducing personal and institutional rates by 0.25%. New rates are 3.00% for savings, 6.00% for personal, and 4.25% for institutional deposits.

NMB Bank

No changes in interest rates—3.02% for savings, 5.50% for personal, and 4.50% for institutional deposits.

NIC Asia Bank

Stable savings and institutional rates, but reduced personal rates by 1.45%. New rates are 3.27% for savings, 4.15% for personal, and 3.00% for institutional deposits.

Siddhartha Bank

Kept savings rates stable while reducing personal and institutional rates by 0.25% and 0.50%, respectively. New rates are 3.00% for savings, 5.50% for personal, and 3.75% for institutional deposits.

Sanima Bank

All rates stable for the new month—3.04% for savings, 5.40% for personal, and 4.30% for institutional deposits.

Machhapuchchhre Bank

Maintained rates for all account types for the month—3.00% for savings, 6.50% for personal, and 4.75% for institutional deposits.

Nepal Bank

Stable rates for all account types—3.01% for savings, 4.55% for personal, and 3.30% for institutional deposits.

According to the directives of Nepal Rastra Bank, banks can maintain a maximum difference of two percentage points for the same type of account. The minimum interest rate for savings accounts and the maximum for term deposits should not exceed five percentage points, while an additional one percentage point can be offered on remittance deposits.

Banks with highest and lowest interest rates

Banks with highest and lowest interest rates

According to the new interest rates, NIC Asia Bank offers the highest at 3.27% for savings accounts, while most banks have set their rates at a minimum of 3%.

For personal term deposits, Machhapuchchhre Bank leads with 6.50%, whereas Everest Bank and NIC Asia Bank offer the lowest at 4.15%.

In institutional term deposits, Machhapuchchhre Bank has the highest rate of 4.75%, while NIC Asia Bank offers the lowest at 3%.

Leave Comment