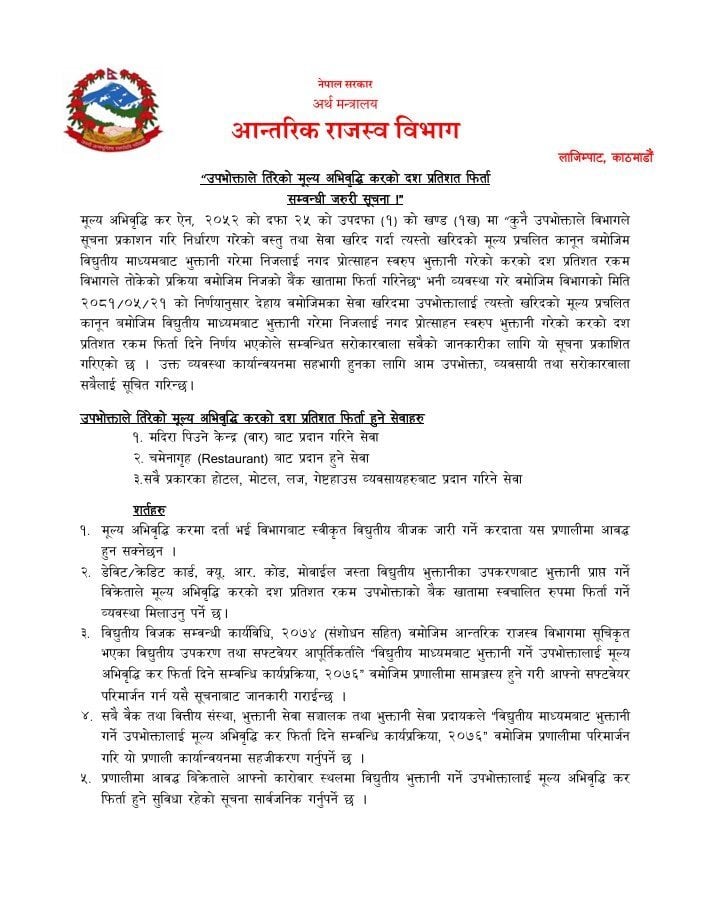

10% VAT refund for electronic payments

Kathmandu, September 9 – It has been decided that consumers will receive a 10% refund on the value-added tax (VAT) paid if the payment is made electronically. The Internal Revenue Department has issued a notice informing consumers, businesses, and stakeholders about this new initiative.

This refund applies to services including those provided by drinking establishments (bars), restaurants, and various types of accommodations such as hotels, motels, lodges, and guesthouses.

As per the decision made on September 6, under section (b) of sub-section (1) of section 25 of the Value Added Tax Act, 2052, consumers who pay electronically for designated goods and services will receive a 10% refund of the VAT paid directly to their bank accounts, following the prescribed procedure.

The conditions for participating in the VAT refund system are as follows: Taxpayers registered for VAT, who issue electronic invoices approved by the department, are eligible to join the system.

Sellers who use electronic payment methods, such as debit/credit cards or QR codes, must ensure that 10% of the VAT is automatically refunded to the consumer’s bank account.

Additionally, electronic equipment and software providers listed by the Internal Revenue Department are required to update their software to comply with the new refund procedures.

All banks, financial institutions, payment service operators, and providers must adjust their systems to facilitate the VAT refund process.

Lastly, sellers participating in this system must publicly announce the availability of VAT refunds for electronic payments at their business locations.

Leave Comment