Chinese vehicle importers under special surveillance of revenue

Tightened inspections at Rasuwa and Tatopani customs, revenue investigation examining BYD's documents

We use Google Cloud Translation Services. Google requires we provide the following disclaimer relating to use of this service:

This service may contain translations powered by Google. Google disclaims all warranties related to the translations, expressed or implied, including any warranties of accuracy, reliability, and any implied warranties of merchantability, fitness for a particular purpose, and noninfringement.

Kathmandu. The government, which has been providing extensive tax exemptions to electric vehicles through the budget, is now at odds with importers. After concluding internally that more than 100 billion rupees in revenue has been lost due to these exemptions in the current fiscal year, the government has become suspicious of importers upon detecting hints of tax evasion.

In the current fiscal year (2080/81), 11,439 electric vehicles have been imported in 11 months. From the start of the current year (Saun) until the end of Jestha, more than 1,000 electric vehicles have been imported each month. The government had encouraged the import of electric vehicles with policies aimed at reducing carbon emissions and the consumption of petroleum products.

Contrary to the explanation given by former Finance Minister Dr. Yubaraj Khatiwada, the subsequent three finance ministers have continuously adopted policies to promote electric vehicles. Dr. Khatiwada had classified electric vehicles as 'luxury items.' According to him, Nepal's infrastructure was not yet ready for the commercial use of electric vehicles.

Accordingly, he explained that only those with petroleum vehicles at home would buy electric vehicles. Based on this, he altered the tax rates. However, there was widespread opposition to the then Finance Minister Dr. Khatiwada's policy, and subsequent Finance Ministers Janardan Sharma, Bishnu Paudel, and Dr. Prakash Sharan Mahat implemented tax policies to encourage electric vehicles.

The government's policy aimed at reducing carbon emissions and shrinking diesel/petrol imports has been manipulated by traders exploiting loopholes, leading to the government's suspicion.

The government concludes that the import of over 11,000 electric vehicles has resulted in a revenue loss of between 100 billion and 150 billion rupees. With suspicions of tax evasion, government bodies have initiated investigations. Most of the electric vehicles imported to Nepal are Chinese brands, leading the government to begin a special surveillance on these brands.

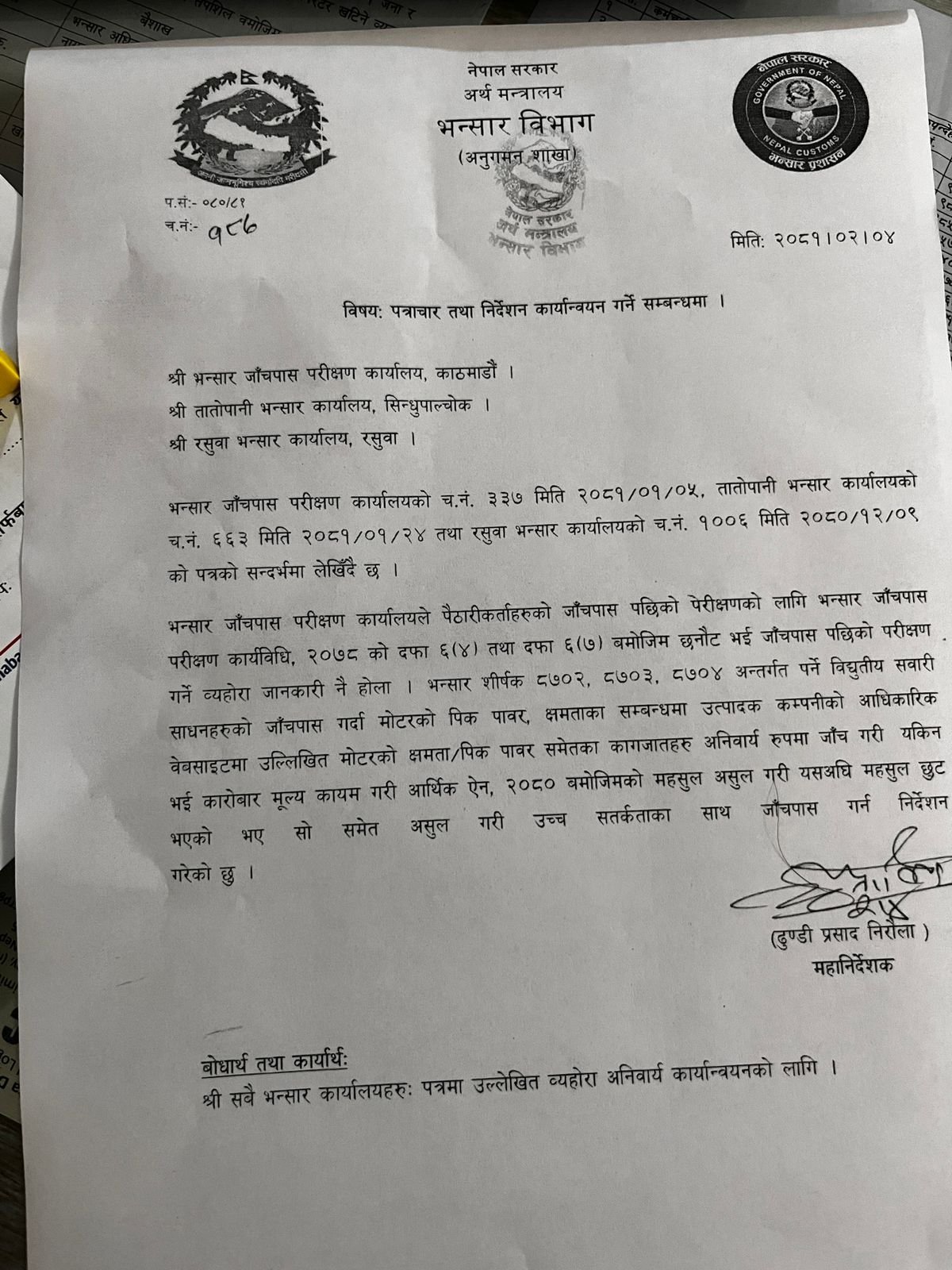

The customs department has tightened inspections, and the revenue investigation department has opened files on the importing companies. This is confirmed by a letter from the customs department addressed to Rasuwa Customs, Tatopani Customs, and the customs clearance office on Jestha 2. Vehicles other than Chinese brands are not imported through Rasuwa and Tatopani Customs. The letter addressed to these two offices suggests that the government suspects Chinese vehicle importers of tax evasion, leading the department to instruct strict inspections at these customs offices.

Similarly, the Revenue Investigation Department has raided the office of BYD importer Cymex Inc. and confiscated documents. The department has requested additional documents from the company, which have been provided.

"The investigation is currently focused on BYD's documents," a department source said. "If faults are found with BYD, other companies will also be investigated."

However, a source close to the Revenue Investigation Department stated that merely investigating does not necessarily prove tax evasion. "If proven, there will be penalties and action; otherwise, a clean chit will be given," the source said.

What are the government's suspicions?

The government suspects that Chinese electric vehicle importers, in collusion with the main manufacturers, have been importing vehicles by reducing the motor peak power and capacity. Vehicles with a motor power capacity of 150 kilowatts in China are being imported to Nepal as having 100 kilowatts or less, thus clearing customs. If it is confirmed during the investigation that the motor peak power and capacity were reduced to clear customs, it could be proven that tax evasion of 15 billion to 20 billion rupees occurred, according to investigating officers.

The manufacturer issues documents showing a vehicle with a motor peak power of 100 kilowatts for a vehicle produced with a motor peak power of 150 kilowatts when clearing customs. For a vehicle with a motor peak power of 150 kilowatts, the customs duty and excise duty combined amount to 40% of the vehicle's value. In contrast, creating fake documents for the same model with a motor peak power of 100 kilowatts only incurs a total of 25% in duties—15% customs duty and 10% excise duty. According to the Economic Act 2080, there is a 15% difference in customs duty between clearing a vehicle with a capacity of 150 kilowatts and one with 100 kilowatts.

Leave Comment